For the majority people, budget is a mundane statistical exercise that offers least appetite and interest equally among the minds of literates and illiterates. Few people know that be it a household or a national economy, the budget is the key index and chief parameter to ascertain the progress and prosperity of the either of the two. In common parlance, a budget can be defined as the estimation of all revenues and expenses of an entity over a specified period of time which is periodically compiled and evaluated on as required basis. In any organizational or national perspective, the budget is linked with the planning process, which is usually based on short-, medium- and long-term requirements. For instance, the country like India has an annual budget (short term plan), five-year plans (medium term plan) and perspective planning keeping the requirements for fifteen years in view (long tern plan). It is through the budgetary allocations only that the governments set and highlight their priorities and trigger the pace of the development as per their vision, mission and approach.

For second year in succession, the Indian budget has been written and presented under the dark clouds of the Covid-19 pandemic. This has been difficult phase for the entire world and so also for the Indian economy sans the Peoples republic of China. More so because apart from the disruption and uncertainty caused by the successive pandemic waves, several technological changes, consumer behaviour, supply-chains, geo-politics, climate change and a host of other challenging factors, quite a few of them being very unpredictable, also have enormous bearing and constraints on the budgetary and planning process. The default mode of policy-making in India and most other countries of the world has traditionally been to rely on a pre-determined “Waterfall” approach i.e., an upfront analysis of the issue, detailed planning and finally the endeavour of its meticulous implementation accordingly. Also some traditional approaches of feedback and review mechanisms have always been there, based on which corrective and readjustment of policy making has always been done in the yester years.

But with the advent of technology in the recent times, a vigorous and more agile framework for the planning and budgeting is available and relevant today due to the explosion of real-time data that allows for constant monitoring and course correction. Such data and information in India include GST (General Service Tax) collections, digital payments, satellite photographs, electricity production, cargo movements, internal/external trade, infrastructure roll-out, delivery of various schemes, mobility indicators, to refer just a few markers here. Although some of these are now readily available on public platforms but several innovative forms of data farming and cultivation methods are now being generated by the private sector too. Therefore, it is easier now to have short-term policy responses and course corrections in any evolving situation. Accordingly, the Union Budget now seeks to complement macro-economic level growth with a focus on micro-economic level all-inclusive progress and welfare. Keeping foregoing factors in view, the Indian Minister for Finance & Corporate Affairs at Centre presented the Union Budget 2022-23 in the Indian Parliament on 1st February 2022 as per the recent tradition in vogue.

The Key Highlights of the Budget

It so often happens that the presenter, the Union Government of India in this case, carries out a job or programme according to its vision, perspective and priorities while the recipients – the opposition, media and public – may have their own interpretation, views and reaction or response. For instance, the government would, in all probability, have to consider their resources and constraints to act accordingly while the common man (user) will be interested to know what is there in store which is personally benefitting them or helping their long term interests. For any knowledgeable and well-meaning person an ideal budget is one that strikes a good balance between the estimated revenue receipts vis-à-vis expenditure with least or none provision for the deficit financing. Therefore, the author proposes to briefly highlight and deal with both the perspectives here; however, the focus will be mainly on the resource allocation with a brief analysis of the resources mobilization part.

A. The Union Government Perspective

The estimated economic growth of the country is pegged at 9.2% which, according to IMF estimates too, appears to be the highest among all larger economies of the globe. Then the government is hopeful to open around sixty (60) lakh new job opportunities under the productivity linked incentive scheme in 14 different sectors. According to initial assessment, the PLI Schemes have the potential to create and additional productivity to nearly thirty (30) lakh crore. During the seventyfifth year of the independence, the Indian government has resolved to commemorate it as the Azadi Ka Amrit Mahotsava (AKAM) in various disciplines and different programmes to that effect have already been undertaken and commenced. Commensurate with the same philosophy, the Union Government has proposed the impetus for growth in Budget in four areas of core priorities declaring the next 25 years as an Amrit Kaal (Amrita Period), which have been referred to as the PM GatiShakti, Inclusive Development, Productivity Enhancement & Investment, etc., and Financing of Investments.

The very first area of priority, PM GatiShakti involves seven engines of the futuristic growth and development namely the Roads, Railways, Airports, Ports, Mass Transport, Waterways and Logistics Infrastructure. The government considers them as the most crucial engines for the economic transformation, seamless multimodal connectivity and logistics efficiency: accordingly, all programmes and projects relating to them are proposed to be dovetailed with the PM GatiShakti framework. According to the projections, the national highways networks shall be expanded by another 25,000 Km during the fiscal year 2022-23 with the mobilization of twenty thousand crore in the same period. Similarly, a capacity augmentation in the railway network upto two thousand Km under indigenous world class technology (Kavach) in 2022-23, and four hundred new generation Vande Bharat Trains and hundred cargo terminals for multimodal logistics are proposed to be developed in three years besides normal incremental growth under other areas. The successive NDA governments have accorded top priority to an all round infrastructure development as this sector not only have an important bearing on all other areas but also offers vast opportunity to employment and improved quality of life.

The second area relates to the inclusive development which inter alia includes agiculture, education, health, skill development, MSMEs (Micro, Small and Medium Enterprises), Saksham Anganwadi, Har Ghar Nal Se Jal, Housing for all, Vibrant Villages Programme, and so on. Some key initiatives in agriculture sector include about 2.37 lakh crore direct payment to farmers for the procurement of wheat and paddy, the provision of NABARD facilitating finance start ups for agriculture and rural enterprise, commensurate allocation to Ken-Betwa project for providing irrigation benefits to nearly 9.08 lakh hectares of cultivable’ lands. The existing Emergency Credit Linked Guarantee Scheme (ECLGS) for MSMEs has been extended upto March 2023 while another 200,000 crore credit facility would come from the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE). In the prevailing global pandemic and technology scenario, several schemes for e-learning have been catered for education and a special ‘National Tele Mental Health Programme’ for quality mental health counselling and care services shall be launched in addition to the existing health care programmes. Approximately two lakh Anganwadis are proposed for upgradation as Saksham Anganwadis. Under the ambitious piped water supply in villages and housing for all citizens, rupees 60,000 crore for water supply to about 3.8 crore households and 48,000 crore for completion of eighty lakh houses have been catered. Information technology-based management of the land records is yet another important initiative in the offing for the inclusive development.

Productivity Enhancement and Investment, Sunrise opportunities, Energy Transition, and Climate Action are third crucial area of thrust in the ensuing budget. The telecom sector envisages a scheme for the design-led-manufacturing to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme (PLIS) in 2022-23. AtmaNirbharta in Defence and export promotion are continuing as the focal point in the government strategy to reduce dependence on defence equipment import with commensurate allocation to the Defence R&D for associating industry, start ups and academia for the purpose. Similarly, the government has also accorded high priority for the research and development in sunrise opportunities such as Artificial Intelligence, Semiconductor and its eco-system, Space Economy, Genomics, Geospatial Systems and Drones, Pharmaceuticals, Green Energy, and Clean Mobility Systems. To promote energy transition and climate action, an additional allocation of over 19,000 have been made for PLI schemes for the manufacturing of high efficiency solar modules to meet the target of 280 GW installed solar power by the year 2030 in an endeavour of minimizing CO2 emissions and dependence on exhaustible energy resources.

The government has also announced a task force to recommend steps for promotion of animation, visual effects, gaming and comic (AVGC) sector with commensurate allocation, which has immense potential to employ the youth in the country. Financing of useful investments is yet another focus area including the promotion of farming, public-private participation under the capital investment programmes, GIFT-IFSC, Data Centres and Energy Storage Systems, Venture Capital and Private Equity investment, Sovereign Green Bonds, Digital Rupee, and so on. The farmers belonging to the Scheduled Castes and Scheduled Tribes and keen to take up agro-forestry shall get preference. Public capital investment outlay has been augmented to 7.50 lakh crore, a sharp increase of nearly 36% over the previous year. Government intends to issue Sovereign Green Bonds for mobilizing resources from the green infrastructure as also introduction of digital currency during the fiscal year 2022-23 among many things. Also core banking facilities are proposed to be introduced in nearly 1.50 lakh post offices and introduction of e-passport with smart chips.

For the commensurate revenue mobilization, the Government has not proposed any change under the already existing slabs of the direct taxes; instead, collection of more funds are expected through an augmented income tax and corporate tax payers’ base. However, it has relied more on a reliable tax regime, further simplification of the tax return, and allowing a window to file updated return within two years on levy of additional tax. Under the indirect taxes, the government has recorded its appreciation for the remarkable progress under the Goods and Services Tax (GST) revenues, which have been considerably buoyant despite the long-drawn pandemic. Reportedly, as on 22 January 2022, the GST collection had a record maximum at rupee 140.9 lakh crore. Government has decided that the customs administration of the Special Economic Zones (SEZs) shall be fully information technology driven on the national portal with effect from 30 September 2022. Certain sector specific changes have been proposed in custom duties and taxes specifically for the electronics, gems and jewellery, textiles, metals, chemicals, MSMEs and exports. The underlying objective of these changes are simplification of the customs rate and tariff structure, elimination of exemption on items manufactured or have potential for manufacturing, and enforcing concessional duties on material needed in line with the objectives of “Make in India” and “Atmanirbhar Bharat”. Overall, a significant gap has been left between the total expenditure and total receipt allowing a fiscal deficit of 6.4% in the ensuing year.

Some other worth mentioning initiatives and schemes under the Union expenditure and revenue budget are the concept of one station one product, national ropeway development plan, promotion of chemical free natural farming, use of kisan drones, interlinking of e-portals namely Udyam, E-shram, NCS anfd ASEEM, digital universities with digital education, one class-one TV channel expansion upto 200 TV channels, establishment of virtual labs for science and mathematics, e-Labs for simulated learning, national digital health ecosystem, establishment of centres for excellence in urban planning, provision for sixty-eight percent capital procurement budget for defence from domestic industries in 2022-23, provision of rupee 100,000 crore to help states in catalysing overall investments in economy, provision of thirty percent taxation on income from transfer of virtual assets (cryptocurrency), surcharge and cess on income and profits now not allowable as business expenditure, tax relief to people with certain disabilities, reduction in alternate minimum tax rate and surcharge for cooperatives, and review of customs exemption and tariff simplification.

B. A Bird’s Eye View: Budget Estimates 2022-23

The total all time high expenditure under the Budget Estimate 2022-23 of the Union is 3,944,909 crore which is an increase by 13.25% over the Budget Estimate 2021-22 and 4.64% over the Revised Estimate 2021-22. As against this, the total revenue receipts comprise of 2,204,422 crore that shows an increase in revenue collection of 23.26% over the previous year’s Budget Estimates and 6.04% over the Revised Estimates. The significant increase in revenue collection over the previous year’s estimates appears to be mainly on account of GST collection. This leaves a staggering gap of approximately 1,740,487 crore between the expenditure and revenue receipts which is proposed to be offset partially through the recovery of loans and other receipts (capital receipts) upto 79,291 crore and remaining 1,661,196 crore through the borrowings and other liabilities. The gap between the total expenditure and total revenue receipts plus non-dent capital receipts represents the fiscal deficit of the government which has been pegged to 6.4% in the ensuing fiscal year.

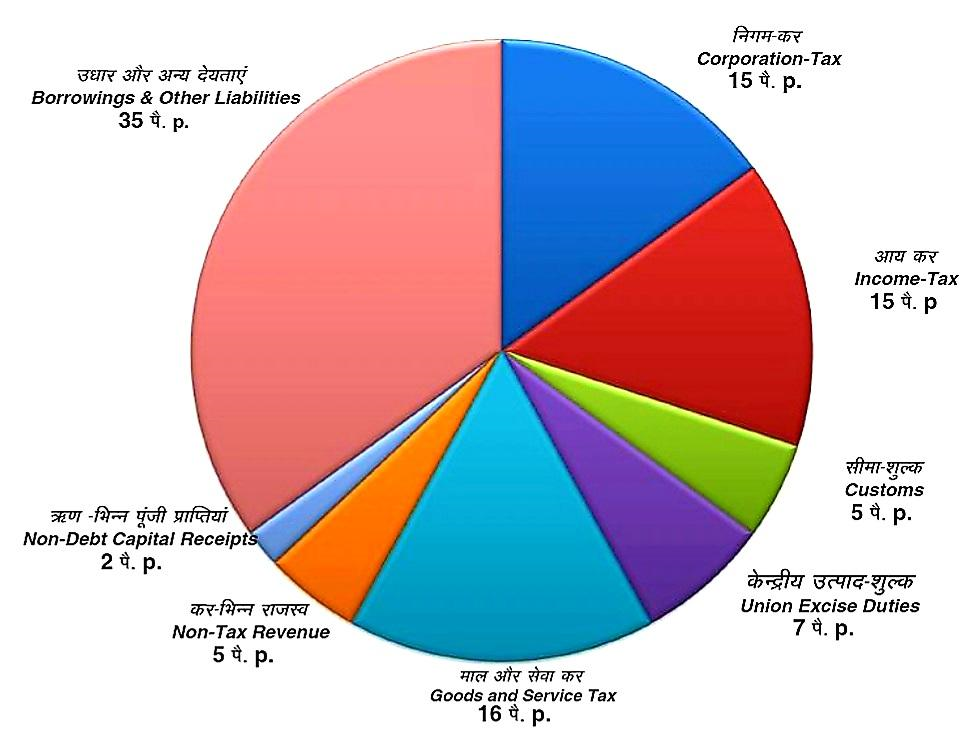

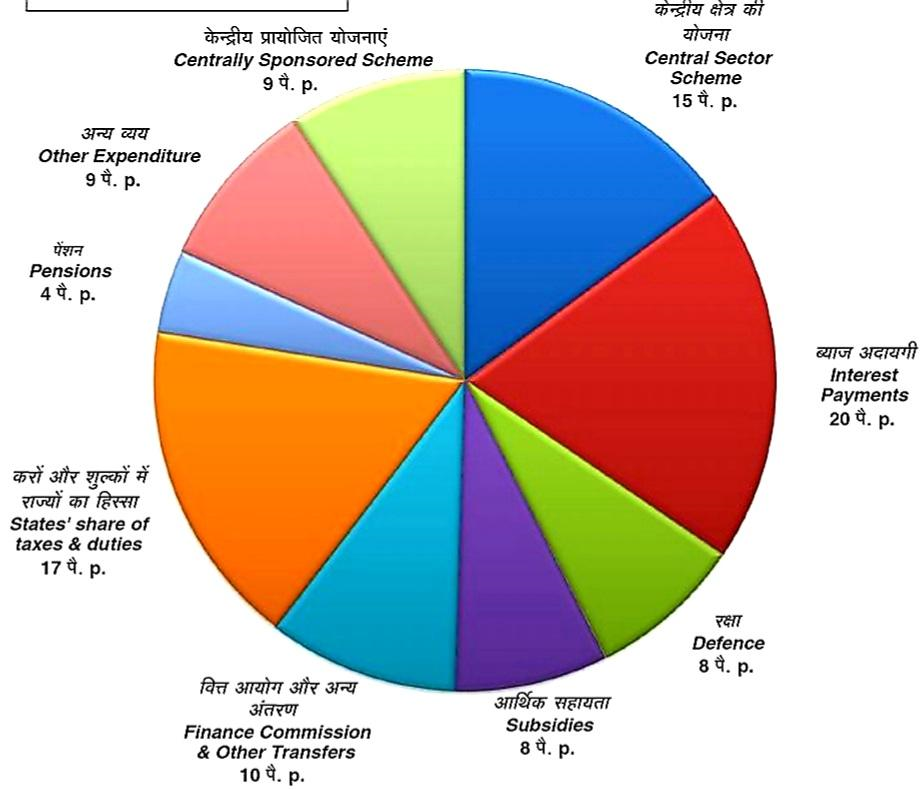

To make it simpler for the readers to understand the true dynamics of the budget from a layman’s point of view, it might be interesting to break the expenditure and receipts upto a rupee level. In that context, every rupee receipt is comprised of Goods and Services Tax 16p, Income Tax 15p, Corporation Tax 15p, Union Excise duties 7p, Customs duties 5p, non-tax revenue 5p, non-debt Capital Receipts 2p, and borrowings and other liabilities 35p. On the other hand, every rupee expenditure is comprised of the Central Sector schemes 15p, Centrally Sponsored schemes 9p, Interest Payments 20p, Other Expenditure (revenue expenditure of all ministries and departments minus Defence) 9p, Defence 8p, Pension 4p, Subsidies 8p, States’ share of taxes and duties 17p, and Finance Commission and other transfers 10p. Total receipts are inclusive of States’ share of taxes and duties, and total expenditure too is inclusive of the States’ share of taxes and duties, which are netted against the receipts. This can be better learnt from the pie charts separately for the revenue and expenditure budget provided in the budget documents of the Ministry of Finance.

To make it simpler for the readers to understand the true dynamics of the budget from a layman’s point of view, it might be interesting to break the expenditure and receipts upto a rupee level. In that context, every rupee receipt is comprised of Goods and Services Tax 16p, Income Tax 15p, Corporation Tax 15p, Union Excise duties 7p, Customs duties 5p, non-tax revenue 5p, non-debt Capital Receipts 2p, and borrowings and other liabilities 35p. On the other hand, every rupee expenditure is comprised of the Central Sector schemes 15p, Centrally Sponsored schemes 9p, Interest Payments 20p, Other Expenditure (revenue expenditure of all ministries and departments minus Defence) 9p, Defence 8p, Pension 4p, Subsidies 8p, States’ share of taxes and duties 17p, and Finance Commission and other transfers 10p. Total receipts are inclusive of States’ share of taxes and duties, and total expenditure too is inclusive of the States’ share of taxes and duties, which are netted against the receipts. This can be better learnt from the pie charts separately for the revenue and expenditure budget provided in the budget documents of the Ministry of Finance.

If we look at the sectoral allocations, the infrastructure (Road Transport and Highways) sector continues to remain a priority area with the allocation of 1,99,108 crore, approximately 52% increase over the previous years’s corresponding provision. The National Highway Authority of India is the chief beneficiary of this augmentation for the improvement and construction of the highways. Railways have received 1,40,367 crore mainly for the improvement and augmentation of railway tracks, construction of a large number of new Vande Bharat trains and cargo terminals. The Communication sectoral allocation comprises of 1,05,407 crore which is an estimated increase of 93% over the revised estimates of previous year mainly for the capital infusion in the Bharat Sanchar Nigam Limited (BSNL 44,720 Cr) and proposed 5G technology. Education and Healthcare & Family Welfare are other very important sectors where government has allocated 1,04,278 crore and 86201 crore representing an increase of 18.5% and 16.6% over the previous years’s provision, respectively. After 2019 general elections, the present government had undertaken an ambitious programme of covering all Indian villages for a piped water supply by 2030 and during the last two years the allocation under the Jal Shakti has increased from 23,199 to 86,189 crore, a phenomenal jump of nearly 252%. PM Kisan Yojna continues to be another welfare scheme for the marginal farmers with 60,000 crore provided in the ensuing fiscal year.

Although the present government is not very favourably inclined to subsidies yet obtaining compulsions of certain sectors such as prevailing economic situation due to Covid-19 pandemic and political environment in the country where some parties and their leaders primarily believe in freebies and subsidies for own survival and empowerment, the government has continued it in certain areas. A major chunk of such allocations have gone in favour of food subsidy with estimated 206,831 crore in 2022-23 for the poor whose work and employment has been compromised owing to the continued pandemic scenario. Then another 1,05,222 crore has been shelved with on account of the fertilizer subsidy for the farmers. The UPA (Congress led) government orders issued in 2010 about withdrawal of subsidy over the petroleum products were effectively implemented in 2014 by the NDA government (BJP led); however, such subsidy under the LPG (cooking gas) and kerosene continued. Now the kerosene use (minimal, if at all any) and subsidy thereupon has been discontinued; the petroleum subsidy comprises of LPG only and 5,813 crore has been catered for it in the ensuing year. Certain other miscellaneous subsidies mainly include interest subsidy, subsidy on price support scheme on the agricultural produce and assistance to the state agencies for procurement, and an amount of 37,773 crore has been provided for the purpose.

India continues to remain the second most populous country with a approximately 140 crore people and is likely to overtake China in the next few years. The Chinese corona virus unleashed from Wuhan towards the end of 2019 continues to cause havoc over the entire world population except China (merely crossed 1 lakh cases sometime back) during its multiple waves so much so that recently USA with about 33 crore population had reported over 10 lakh new cases and another small country like France with barely 6 crore population about 5 lakh cases in a single day. On the other hand, India despite its population and many constraints has not only managed it well so far but also undertaken the largest free and successful vaccination programme for its citizens. A provision of 87,000 crore has been catered in the Budget Estimate 2022-23 for this purpose. This analysis will remain incomplete if Defence is not mentioned here, an area which was constantly ignored or given low priority by the previous governments. With two potential adversaries, or we can call them enemies, with constant hostilities on the eastern and western borders, Defence has continued to receive a high priority during the last seven years. Accordingly, an allocation of 525,166 crore has been made in the next year’s budget for this purpose.

Author’s Take on Budget 2022-2023

In India, the presentation of Budget generates an instant reaction from the ruling and opposition parties on the predicted lines every year and a parallel heated debate in media for a few days. Interesting feature is that these reactions, responses and opinions often come from those conducting and posing like experts with least knowledge or understanding of the planning and budgetary process. Of course, occasionally few sane opinions and meaningful analysis is also made by the sources who actually know and understand it. Notwithstanding, it is the opposition parties and media that often hog limelight with their often ignorant, occasionally humorous and sometimes bizarre arguments. However, all this is not surprising because, after all, the country also has the honour of producing Nobel laureate economists with kinds of vision that the progress will be achieved if the government of the day agrees to dole out to the poor and marginal population with freebies such as rupees six thousand per month under NYAY. So to begin with, it would be in fitness of things if the author deals with the reaction of two key opposition leaders, who also represent two ideologies and approaches, and thereby the aspiration and opinion of a large section of opposition, media and intellectuals of this country.

Mr Rahul Gandhi, an MP from Waynad, Kerala, yet the de facto leader and PM stuff of the main opposition Congress Party, had a quick tweet on Budget as follows:

@RahulGandhi M0di G0vernment’s Zer0 Sum Budget!…Nothing for (the) Salaried class – Middle class – The poor & deprived – Youth – Farmers – MSMEs. (1:40 PM · Feb 1, 2022)

In more successive tweets, directly attacking the Prime Minister for Jumlas (bluff or false statements), he charged that the Modi government has destroyed the unorganized sector and MSMEs responsible for jobs; hence the government slogan “Make in India” has, in fact, now become ‘Buy from China’. Then in another tweet, he has again reiterated the party promise in the Congress Manifesto to electorate during the parliamentary elections of 2019 of doling out ₹6,000 every month to all poor families so that no one is hungry and parents are not worried about child’s education…a concern the oldest party has been expressing since 1947 and still believing that NYAY (Nyuntam Aay Yojana) is a surgical strike against poverty and the existing government favours only richest few.

Rather than wasting time of the readers by individually examining all issues, the truth behind his criticism and allegations could be elicited by just taking one crucial example of MSMEs in the present government’s budget. The government has extended additional credit under the ongoing Emergency Credit Linked Guarantee Scheme (ECLGS) to about 130 lakh MSMEs upto March 2023 by expanding the guarantee cover by another 50,000 crore to make it a total 500,000 crore. Further, an additional credit of 200,000 crore shall be facilitated to Micro and Small Enterprises under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE). Besides, relevant portals such as Udyam, e-Shram, NCS and ASEEM are proposed to be inter-linked. Another 6,000 crore has been allotted for raising and accelerating the MSME performance programme. Here it may also be relevant to remind the readers that the same government had undertaken measures for MSMEs during the previous stint to generate more employment and self-sufficiency through business opportunities.

Yet another leader Sitaram Yechury of the Communist Party (Marxists) tweeted as under followed by many more visionary (!) tweets in his own wisdom and reckoning.

@SitaramYechury: Govt tom-tomming 35.4% increase in capital expenditure. This includes repaying Air India loan not backed by assets of nearly ₹52Kcr. Minus this and purchasing defence equipment ✈ï¸Â capital expenditure is lower than last year allocation. ‘Lies, Damned Lies & Statistics’.

While the author is impressed with this great economic vision and outlandish choice of words but there seems to be nothing that has been suppressed or hidden by the government meriting such condemnation with chosen words “lies, damned lies…” The statement in the budget documents itself clarifies that the capital outlays in the estimates of 2021-22 include the infusion/loans to AIAHL/AI for settlement of past guarantees and sundry liabilities, not backed by assets amounting to 51,971 crore, and excluding this amount the estimated revised estimates under the capital expenditure is 550,740 crore. The Air India and allied companies had been making constant losses during the ten years of UPA regime, of which CP(M) was also an active constituent before withdrawing support over the Indo-US civilian nuclear agreement in 2008. The question is what all they did to revive the company with constantly accumulating liabilities year after year. Reaching a point of no viable revival, the incumbent government decided to disinvest and transfer control to Tatas settling past liabilities. Of the 750,246 crore earmarked on the capital account in 2022-23, 152,000 crore is for Defence; so it is difficult to understand the communist stalwart’s objection, or he perhaps feels capital outlays for the defence services are of no worth to the country.

There is yet another important fact that every politician and common man must learn. Unlike the revenue expenditure which is always incremental owing to its recurring and repetitive nature and inflation, the capital outlays are made for creating durable assets with certain long-term objectives. The capital schemes necessarily require heavy investment with long drawn trajectory of its materialization and payments. Hence expenditure under capital is not always uniform and subject to actual materialization of certain landmark stages in procurement or final delivery; hence it need not be incremental as surmised or understood by Mr Yechuri. One cannot but have sympathy with the understanding of such political leaders who do not need any expert study or understanding before they speak or write even on technical subjects with authority. However, the author feels that for the peace and progress of any nation, its borders too need to be secured for which state of the art weapon and equipment are equally necessary if not more, and therefore enhanced capital outlays for the Defence are necessary striking a balance between resources and constraints.

Actually, instead of making it a populist budget with freebies, concessions or income tax rebate, this budget has all-encompassing features of a sustained vision and future growth with all time high allocation under the expenditure (Rs 39,44,909 crore) and receipts (Rs 22,83,713 crore) with the estimated nominal GDP growth i.e., actual growth plus inclusive of inflation pegged at 11.1%. Even the ministry / sector wise allocation too shows highest rise under Communications (93%), Road Transport and Highways (52%) and Jalshakti (25%) which are indicators of the growth and development only. Although any relief on income tax slabs has not followed but the taxpayers have been provided a window for filing and updation of the income tax return upto two years on payment of certain penal charges. In the ensuing year, the government plans to introduce own cryptocurrency through RBI with a provision of 30% tax on income from the transfer of cryptocurrencies and non-fungible tokens with no set off provision against losses, if any.

The infrastructure projects, roads and highways, railways and telecom have received special attention in the budget as real engines of growth and development. In that spirit the transport and logistics projects are proposed to be realigned with recently launched PM GatiShakti framework. As already mentioned earlier, the National Highways network has been planned for expansion by 25,000 km in 2022-23, an optimistic target by all means. The concept of one-station-one-product under railways has been floated with a view to help local businesses and supply chains and an achievable target has been fixed for 400 Vande Bharat trains and 100 Cargo terminals in three years. 5G mobile services are planned in the ensuing fiscal year and commensurate allocation provided to facilitate an ecosystem for 5G as part of the Production Linked Incentive (PLI). Similarly, a reasonably balanced approach has been attempted towards energy and environment needs in the budget.

Government has revealed their policy and vision from time to time about the subsidies and the subsidies already dispensed with under the petroleum products sans LPG. However, essential food, fertiliser and other miscellaneous subsidies have been retained. MGNREGS (Mahatma Gandhi National Rural Employment Guarantee Scheme), introduced in 2005 by the UPA regime providing 100 days of guaranteed wage employment in rural areas in a financial year, has largely been unproductive in creating any substantive assets but as a welfare measure and political compulsion, it has been continued with a provision of substantial 70,000 crore. Jal Jeevan Mission/National Rural Drinking Water Mission, Pradhan Mantri Awas Yojana, National Education Mission, National Health Mission, Saksham Anganwadi and POSHAN 2.0, Modified Interest Subvention Scheme, Pradhan Mantri Gram Sadak Yojana, Pradhan Mantri Fasal Bima Yojana, National Livelihood Mission-Ajeevika, Pradhan Mantri Krishi Sinchai Yojana and Rashtriya Krishi Vikas Yojana are some of the major schemes largely catering the needs of the rural India. Similarly, Welfare of Women (171,006 crore), Welfare of Children (92,737 crore), Scheduled Castes (142,342 crore), Scheduled Tribes (89,265 crore) and North Eastern Region (NER) (76,040 crore) are allocation for the schemes of weaker and vulnerable sections often ignored in the past.

In opposition’s view, it may be a ‘Zer0 Sum Budget’ but to this author’s mind, it is a satisfactory engine of growth. If the planning and budgeting is effectively managed for the next few years with subsequent efficient execution and implementation of the schemes and programmes, the projected dream $5 trillion economy may indeed come true. However, one important issue of concern is constantly growing fiscal deficit in the Union Budget. The fiscal deficit is the gap between the total expenditure and the revenue receipts plus non-debt capital receipts (NDCR), which reflects the state of the total borrowings of the government. According to the Fiscal Responsibility and Budget Management (FRBM) Act, 2003, the Central Government must progressively minimize its outstanding debt, revenue deficit and fiscal deficit as too much borrowings may not be good for the overall health of the economy. Usually, a moderate fiscal deficit is acceptable because when a lot of investment is made in infrastructure projects which in turn boost economic growth and employment opportunities but the current fiscal deficit at 6.4% is certainly not acceptable. It is understandable that the government is endeavouring to sustain a higher growth (projected 9.2%) in GDP under obtaining constraints of Covid-19 pandemic and certain populist yet unproductive schemes due to political compulsions but this trend needs to be reversed early and onus devolves on the incumbent government to take necessary measures for the same.

Postlude

This author has been closely watching two national parties viz. the Congress and the Bhartiya Janta Party (BJP), with the largest reach and electoral base in the country, nearly for two decades for their election manifesto, its subsequent compliance and efforts towards alleviation of the poverty. Strangely enough, both the national parties present a sharp contrast in their ideology and approach towards the development and growth. No need to calling names but the successive Congress governments gave a loud call and publicity for the poverty alleviation, made fanciful announcements but remained stuck with the traditional regime of subsidies and freebies or largely non-productive MGNREGA like schemes accruing only marginal benefits without any significant improvement in the standard of living and economic condition of people; NYAY is the latest wonder in the Congress camp summarily rejected by the electorate in 2019 General Election. On the other hand, BJP under Narendra Modi has focused on the empowerment of the poor and marginal population instead of offering subsidies and freebies in cash. The provision of pucca houses under PM Awas Yojna, LPG connections to over 4 crore families, direct transfer of financial assistance/subsidy, power connections, sanitation, piped water supply in villages, easy credit to start business/self-employment, and dozens of such other ongoing schemes are concrete steps towards improving the quality of life. For these reasons, the incumbent regime generates hope among the masses despite constant conspiracies, subversive acts and toolkits to divide and disrupt the incumbent government and their development model.

Acknowledgement: The author has gratefully consulted various Budget documents of the Ministry of Finance available in public domain for the budgetary data and schemes referred to in this article.

32,880 total views, 25 views today

No Comments

Leave a comment Cancel