The Finance Minister Nirmala Sitaraman presented the Union Budget of India on 1st February 2023 in the Lower House of Parliament explaining the Budget Estimates (all anticipated revenues and expenditure) and associated schemes and programmes for the ensuing Financial Year 2023-24, along with the Revised Estimates 2022-23 on more realistic assessment towards the last quarter. For the majority people, budget is merely a routine statistical exercise and few people know that the budget is the key index and chief parameter to ascertain the progress and prosperity be it a national scenario or an ordinary household. For the last two consecutive years, the Union budget was written and presented under the dark clouds of the Covid-19 pandemic, a very difficult phase not only for the Indian economy but also for the entire world. The economy has shown some positive signs of recovery only during the current year, with the country remaining largely free from the coronavirus menace during the most part of the year. Apart from the disruptions and uncertainties caused by the pandemic, several other compelling factors such as consumer behavior, geo-politics, supply-chain issues, rapid climatic changes and a host of other factors influence the budget preparation and planning process these days.

In ordinary parlance, the Government of India Union Budget is defined as the estimation of all revenues and expenses of the particular financial year which is constantly assessed, compiled and voted by the Parliament after due evaluation in a periodic annual cycle. Few people know that in the organizational or national perspective, the budget is closely linked with the planning process based on short-, medium- and long-term requirements. To further illustrate this point, India has an annual budget (short term plan), five-year plan (medium term plan) and perspective plan (long term plan) keeping focus on the requirements for the next fifteen years in view. However, it is through the annual budgetary allocations that the government sets and highlights its output and outcome based priorities carrying out the pace of the development and progress as per envisaged vision, mission and goal(s). A few markers of recent origin such as General Service Tax (GST), digital payments, deliverance of schemes, infrastructure roll-out, satellite imageries, to name just a few, too now play a vital role in the planning process. Keeping all such factors in view, the Union Budget 2023-24 has been presented as per the recent tradition in vogue and the author proposes to provide a brief analysis thereof under various disciplines and heads.

Analysis of the Union Budget

This year’s Union Budget is significant and special because it is also the fifth and last budget of Prime Minister Narendra Modi led government’s second successive stint. Since independence, the Union Budget has also been used as a tool for projecting the government’s priorities on policy making, structures development plan and populist schemes, subsidies and freebies to attract common masses i.e. the middle class and poor people. For a well-meaning person, an ideal budget should be one that strikes a good balance between the estimated revenue receipts vis-à-vis expenditure with minimum or no deficit financing. On the other hand, most of the corporate, businessmen, service class and ordinary folks look at the budget from their perspective i.e. how it suits their interest and what all is catered in the budget for their personal welfare and gain. On their part, the government needs to consider all available resources and constraints while presenting a balanced budget taking into account interests of all classes simultaneously keeping in view that the deficit financing is kept to the minimum for the long term fiscal health and discipline. In the following paragraphs, this author proposes to briefly analyze the perspectives of government as well as the target population.

A. Budget Estimates 2023-24: A Bird’s Eye View

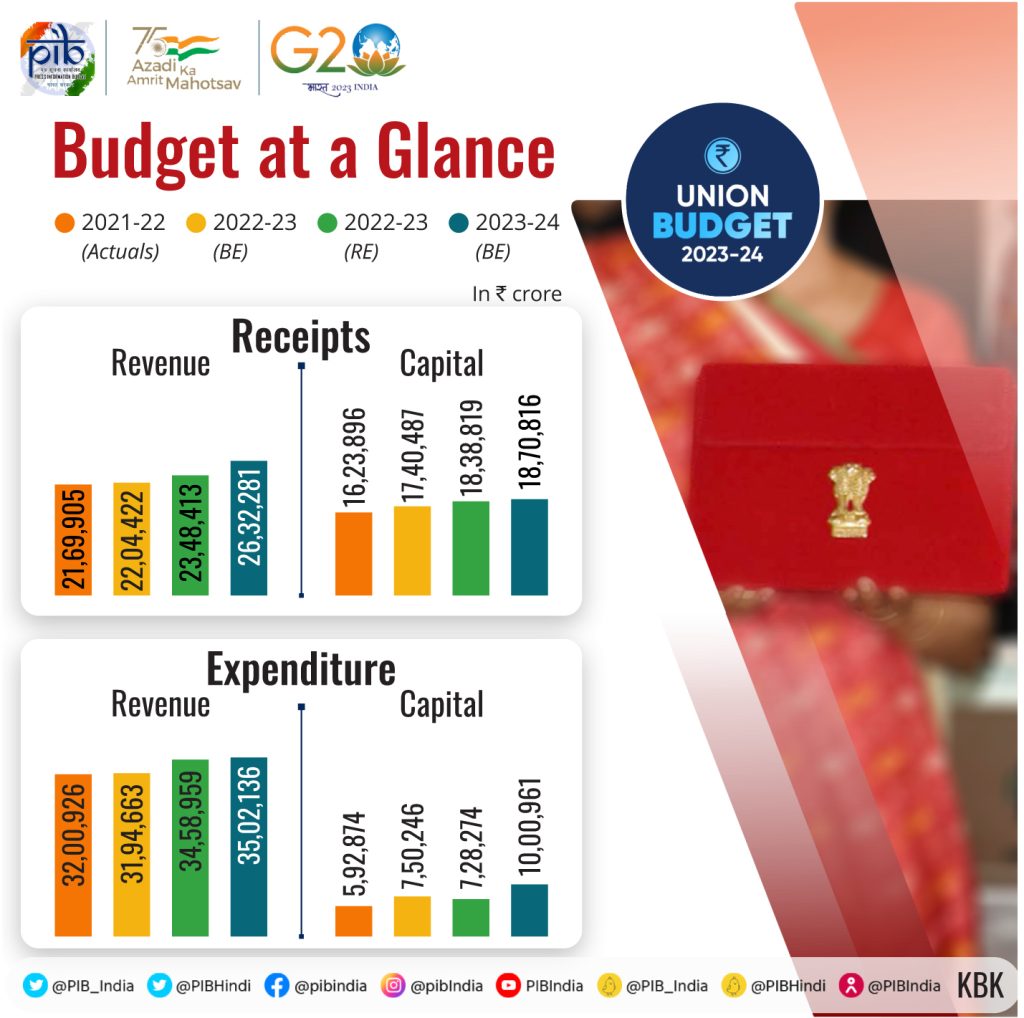

The total budgeted expenditure in BE 2023-24 is 45.03 lakh crore which represents an increase by 14.14% over the BE 2022-23 and 7.54% over the RE 2022-23. Of this, the total effective Capital expenditure is 13.71 lakh crore (including 10.01 lakh crore on capital account and 3.70 lakh crore Grants in Aid for the creation of capital assets) which represents an increase of more than 30 per cent over RE 2022-23. Thus higher allocation under the Capital Outlays is on account of the Central Government’s strong commitment to boost economic growth by investing more in infrastructure development particularly Railways and Roads and manufacturing sector. The corresponding total receipts are 27.16 lakh crore, comprising of of 26.32 lakh crore as Revenue Receipts from the tax and non-tax revenues and 0.84 lakh crore as Capital Receipts through recoveries of loans and other receipts, leaving a staggering gap of 17.87 lakh crore to be raised from the borrowings and other liabilities – representing the Fiscal Deficit of the government. The significant increase in revenue collection over the last year’s estimates is mainly on account of the continuous increase in GST collection.

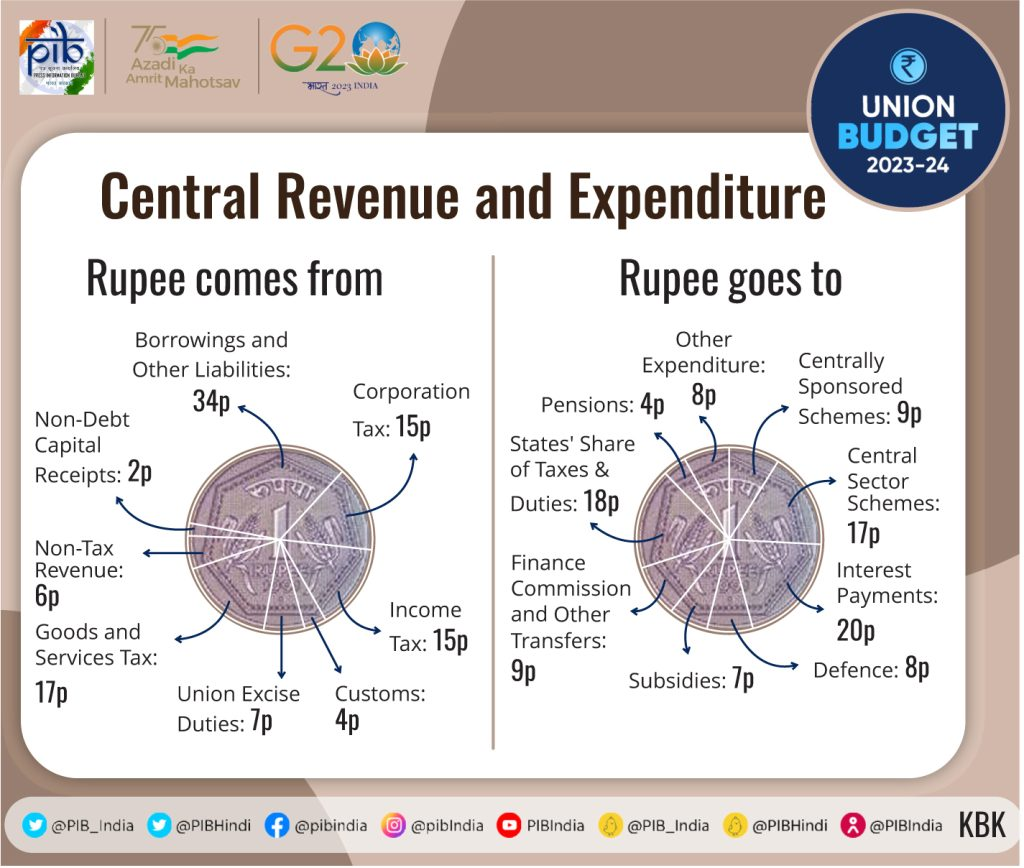

To learn the dynamics of the Union Budget from a layman’s point of view, one may find it convenient and interesting to break the aforesaid expenditure and receipt up to one rupee level. In that context, every rupee receipt is comprised of Goods and Services Tax 17p, Income Tax 15p, Corporation Tax 15p, Union Excise duties 7p, Customs duties 4p, non-tax receipts 6p, non-debt Capital Receipts 2p, and borrowings and other liabilities 34p. On the other hand, every rupee expenditure is comprised of the Central Sector schemes (sans Capital Outlays on defence and subsidy)17p, Centrally Sponsored schemes 9p, Interest Payments 20p, Other Expenditure (revenue expenditure of all ministries and departments excluding defence) 8p, Defence 8p, Pension 4p, Subsidies 7p, States’ share of taxes and duties 18p, and Finance Commission and other transfers 9p. Total receipts are inclusive of States’ share of taxes and duties, and total expenditure too is inclusive of the States’ share of taxes and duties, which are netted against the receipts. This position is understood more clearly from the pie charts for the Receipts and Expenditure Budget. (Source: MOF website)

While making sectoral allocation, the Finance Minister has taken care that none of the areas are unduly neglected or any imbalance is created. In some cases, increase over the last year’s allocation or rather lower resource allocation is noticed but this is mainly because higher sectoral allocation made in the previous year was not fully utilized or there was no higher demand as such owing to the very nature of expenditure. However, certain sectors like the infrastructure segment comprising of Roads, Transport & Highways and Railways continue to remain a priority area with high allocation. For instance, the previous year’s Budget allocation (BE 2022-23) for Roads & highways of over 1.99 lakh crore was itself an approximate 52% increase over the previous year’s corresponding provision. In the BE 2023-24, this has been further augmented to over 2.70 lakh crore which represents an increase of 35.82% over the last year’s Budget Estimates and 24.61% over the Revised Estimates, which inter alia suggest full utilization and good progress made during the current financial year. The National Highway Authority of India is the chief beneficiary of this augmentation for the improvement and construction of the highways and here the point need to be noted that infrastructure development is not only good for the sectoral growth in terms of employment generation and ease of living but also an essential requirement for the overall growth and development of the country and various sectors of the national economy.

The Railways have received constant push during the two regimes of the NDA government led by Mr Narendra Modi for the same aforesaid reason with continuous improvement, updradation and augmentation of railway tracks, introduction of a large number of new comfortable and high speed passenger trains, and cargo terminals. The rapid progress in this segment could be fathomed from the fact that an all time high allocation of over 1.40 lakh crore was further augmented to 1.62 lakh crore in the Revised Estimates of the same year and a big jump to over 2.41 lakh crore has been made for the financial year 2023-24 that represents an increase of over 1.01 lakh crore in the real term and 72% in the percentage term. The Communication sector is yet another crucial area which has received constant priority of the federal government with an allocation of 1.23 lakh crore for the inclusive development and adoption of newer technologies besides sustaining the development already made so far. In this context, the remarkable point is that the sectoral allocation of over 1.05 lakh crore on Communication made last year itself represented an increase of 93% over the revised estimates of previous year which included the capital infusion in the Bharat Sanchar Nigam Limited (BSNL) and the 5G technology. Now this year’s allocation indicates more than 17% under the Communication sector over the previous year.

Among the schemes of the social welfare and mass outreach, Education, Healthcare & Family Welfare and agriculture continue to be priority segments with adequate resource allocation. For instance, allocation for the Department of Pharmaceuticals alone with 3060 crore in BE 2023-24 represents more than 28% the revised allocation during the current year. Of this, an allocation of 1,250 crore is earmarked for the development of the Pharmaceutical industry, a phenomenal increase over just 100 crore during the previous year. Allocation under the Ayush Mantralaya for the Pradhanmantri Ayush Yojana is 3,648 crore, depicting more than 28% increase over the previous year. After 2019 general elections, the NDA government had undertaken an ambitious programme of covering all Indian villages for a piped water supply by 2030 and 70 thousand crore has been allocated for the Jal Jeevan Mission alone in the ensuing year. Similarly, a provision of over 20 thousand crore has been made for the River Development and Ganga Rejuvenation. The tribal population, particularly of the northeastern states, had been traditionally ignored by the successive previous governments. The development of the northeastern states had been undertaken at a large scale by the present government since 2014 to bring the tribal population in the national mainstream. Accordingly an allocation of 12,462 crore in BE 2023-24 represents an augmentation of 54.91% for the tribal affairs over the Revised Estimated 2022-23.

B. Budget as An Engine of Inclusive Growth

During her Budget presentation speech, the Finance Minister made a significant announcement that this was the first Budget of the “Amrit Kaal” and their government’s vision for the Amrit Kaal included a technology-driven and knowledge-based economy with strong public finances and a robust financial sector. She added that to achieve this vision the ‘jan-bhaagidari’ (public participation) through ‘sabka saath, sabka prayas’ (combined efforts by all) was essential. The term Amrit Kaal was coined and first used by Prime Minister Narendra Modi in 2021 in the context of 75th Independence Day celebration while delivering his speech from the ramparts of the Red Fort in Delhi. A constant dreamer he is; he said that the goal of Amrit Kaal was to ascend to new heights of prosperity for India and the citizens of India. He further expanded this period to a roadmap of the next twenty-five years during which the country must endeavour to work towards improving the lives of its citizens, reduce the divide between the cities and villages, minimize the government interference in people’s lives and build modern infrastructure in India.

The term ‘Amrit Kaal’ is said to have been derived from the Vedic astrology equating it to a sort of golden era. While growth in four core areas of priorities adopted during previous year’s Budget viz. the PM GatiShakti, Inclusive Development, Productivity Enhancement & Investment, and Financing of Investments continue hitherto fore, as highlighted through the first Budget of Amrit Kaal, its core vision includes three-objectives namely opportunities for citizens with focus on youth; growth and job creation; and strong and stable macro-economic environment. In her long-drawn Budget speech, the Finance Minister painstakingly explained four opportunities and Satarishi-7 priorities to achieve the intended vision. Briefly, the four transformative opportunities include: 1) Economic Empowerment of Women; 2) Prime Minister Vishwakarma Kaushal Samman aka PM VIKAS targeting the traditional artisans and craftsmen; 3) Tourism – developing and making best use of the country’s immense tourism potential; and 4) Green Growth i.e. implementing various programmes for green fuel, green energy, green farming, green mobility, green buildings, green equipment, and so on, and making policies for efficient use of energy across various economic sectors.

The Budget documents for the ensuing year has highlighted the following seven priorities to remain as guiding force throughout the Amrit Kaal, being complementary to each other, and were dealt with at length by the Finance Minister during the Budget presentation. These priorities under the nomenclature of Saptarishi-7 are briefly as follows: 1) Inclusive Development, 2) Reaching the Last Mile, 3) Infrastructure and Investment, 4) Unleashing the Potential, 5) Green Growth, 6) Youth Power, and 7) Financial Sector. Inclusive development is broadly reflected in the Government’s ideology of Sabka Saath Sabka Vikas that addresses inclusive development of farmers, women, youth, OBCs, Scheduled Castes, Scheduled Tribes, divyangjan (disabled) and economically weaker sections, and overall priority for the underprivileged. Similarly, under the same philosophy, sustained focus is also extended to the people of the states and union territories of Jammu & Kashmir, Ladakh and the North-East.

It’s obvious that numerous schemes, resource mobilization and allocation under all the aforesaid seven priorities can neither be explained nor accommodated within the scope of this essay; hence only a few items are cited here for illustration. The multi-discipline inclusive development inter alia caters for agriculture, horticulture, fisheries, health, education, skilling, medical and pharma services, and so on, with a provision of increased credit upto 20 lakh crore with special focus on animal husbandry, dairy and fisheries. Inclusive development is not a new concept and, in fact, the present government has already been working on it leading to over 47.8 crore Jan Dhan bank accounts, 11.7 crore household toilets under the Swachh Bharat Mission, 9.6 crore LPG connections under the Ujjawala scheme, 220 crore Covid vaccination of about 102 crore persons, insurance cover for 44.6 crore persons under the Suraksha Bima and the Jeevan Jyoti Yojana, cash transfer of 2.2 lakh crore to over 11.4 crore farmers under Kisan Samman Nidhi so far during the last few years. The ministries of Ayush, Fisheries, Animal Husbandry and Dairying, Skill Development, Jal Shakti and Cooperation were in fact created in recent years keeping in view to reaching the last mile priority which among other things also includes the PM Awas Yojana with outlays of over 79,000 crore. Two other development programmes are aimed at particularly vulnerable tribal groups (PVTG) with planned investment of 15 thousand crore in next three years and creation of urban infrastructure in the Tier 2 and 3 cities.

The Government focus on the development of infrastructure and investment potential needs no emphasis owing to its large multiplier impact on growth and employment and any aware person can learn it from massive increase in sectoral allocation and progress achieved during the last few years. Under the priority ‘Unleashing of Potential, several programmes have already been launched or proposed to be launched through the current budget, These inter alia include programmes like Mission Karmayogi, Centres of Excellence for Artificial Intelligence, National Data Governance Policy, Simplification of Know Your Customer (KYC) process, One stop solution for identity and address updating, Common Business Identifier for ease of doing business, Unified Filing Process to obviate submission of repeated personal data and information, Vivad Se Viswas for relief to MSMEs and settlement of contractual disputes, E-courts, Result Based Financing, to name a few.

Under the Green Growth, a vision for life as environmentally conscious lifestyle has been conceptualized and several schemes and programmes including Green Hydrogen Mission, Energy Transition, Energy Storage Projects, Renewable Energy Evacuation, Green Credit, PM-Pranam, Govardhan, MISHTI, Amrit Dharaohar for the restoration of Wetlands vital to ecosystems sustaining biological diversity, and so on, are either already launched or envisaged in the ensuing year with commensurate resource allocation. For instance, the recently launched National Green Hydrogen Mission, with an outlay of 19,700 crore, is aimed at facilitating transition of the economy to a low carbon intensity, reduce dependence on fossil fuel imports, and make the country to assume technology and market leadership in this sunrise sector. Similarly, the Budget caters for 35,000 crore on account of priority capital investments towards energy transition, net zero objective and energy security. Under Renewable Energy Evacuation, the Inter-state transmission system for evacuation and grid integration of 13 GW renewable energy from Ladakh is planned with an investment of 20,700 crore including the Central support of 8,300 crore.

In the context of a crucial priority to Youth Power, nicknamed Amrit Peedhi, earlier a National Education Policy was already formulated with the focus on skilling and economic policies which would facilitate job creation commensurate to modern age at ample scale with enough business opportunities. This inter alia includes Pradhan Mantri Kaushal Vikas Yojana 4.0 covering courses for Industry such as coding, Artificial Intelligence, robotics, mechatronics, 3D printing, drones, etc., Skill India Digital Platform for skilling of youth in different trades and National Apprenticeship Promotion Scheme to provide stipend support to 47 lakh youth in three years. Tourism and Unity Mall are other area where the government intends to focus for the sustained development. The Financial Sector priority includes a slew of measures like Credit Guarantee for MSMEs, National Financial Information Registry, Financial Sector Regulations, Improving Governance and Investor Protection in Banking Sector, Capacity Building in Securities Market, Central Data Processing Centre, Digital Payments, Fiscal Management, and so on.

This analysis will remain incomplete if two important expenditure areas namely Defence and Subsidies are not mentioned. While the Defence of the country has received maximum attention under the NDA government led by Mr Modi but the Government has not been very favourably inclined towards subsidies. However, certain compulsions including the prevailing economic situation due to Covid-19 pandemic and political environment in the country whereunder almost all opposition parties overly emphasize and resort to freebies and liberal subsidies culture for their survival and empowerment, have forced this government to continue subsidies in certain sectors. A major chunk of the subsidy allocation has gone as the food subsidy with more than 1.97 lakh crore in 2023-24 for the poor and less privileged which, however, represents a reduction by 31% from the Revised Estimate of over 2.87 lakh crore for 2022-23. Fertilizers is yet another crucial area where the government has earmarked over 1.75 lakh crore in 2023-24, a 22% drop from the Revised Estimate of more than 2.25 lakh crore for 2022-23. Then the Fuel subsidies have been budgeted at 2,257 crore, representing a reduction of nearly 75% from the current year’s Revised Estimates of 9,171 crore. The flip side of the food subsidy is that the discontinuance of free food grain disbursements under the Pradhan Mantri Garib Kalyan Yojana (PMGKY) shall lead to a drop in the ensuing year but extension of the same under the National Food Security Act for yet another year would increase the liability say by at least 2.0 lakh crore more.

As for the Defence, this is an area which had been constantly ignored and given low priority by the successive Congress or Congress led governments. The usual and strange logic given for this approach was inadequate resources and avoidance of arms race in the sub-continent, particularly keeping in view potentially strong and powerful People’s Republic of China (PRC) as neighbour. With two potential adversaries and their continued hostilities on the borders, the Defence of country has received high priority during the last two successive governments with Mr Narendra Modi as prime minister. Accordingly, an allocation of 5.96 lakh crore have been made for 2023-24, which represents 13.52% increase over the previous year’s 5.25 lakh crore. Of this, 1.62 lakh crore is earmarked for the capital spending on procurement of weapons and equipment, aircraft, warship and other military hardware. A capital outlay of about 5,000 crore has been separately provided for the border roads and associated infrastructure during the year. Such allocations are in accordance with the current zero-tolerance policy of India towards violations on border incurred by China and Pakistan and, thereby, the express need for creating the border infrastructure and adopting commensurate modern technology for the armed forces.

It is a settled principle that for incurring the budgetary expenditure on various programmes and activities, the commensurate revenue mobilization is also essential. Keeping in view the limitations of this write-up, the author is not going into the nitty-gritty of the taxation, borrowings and other miscellaneous revenue sources. In a nutshell, however, probably keeping the next General Elections in view, the Government has avoided any major changes in the existing direct tax regime, except for giving relief to income tax payers, more rationalization and simplification in certain areas and fine-tuning of rates here and there. Under the indirect taxes, the remarkable progress under the Goods and Services Tax (GST) revenues has continued hitherto fore, which achieved constantly improved quarterly collection in recent past and in the ensuing year tax collection from GST has been estimated at 17% of the total receipt budget. Customs duty on several items has been revised; on certain items such as gold, platinum and aeroplanes, the amount of cess has been increased with the corresponding decrease in customs duties. As against the expenditure budget of 45.03 lakh crore in BE 2023-24, the receipts other than the borrowings are estimated at 27.16 lakh crore leaving a staggering gap of 17.87 lakh crore as fiscal deficit, which works out to 5.9% of the GDP.

The Media and Environment Response

Traditionally, the presentation of Union Budget generates an instant reaction on predicted lines from the opposition and ruling parties year after year. This is perhaps owing to a misplaced notion or belief that a member of opposition must criticize every move and action of the party or government irrespective of the merit of the case or issue under consideration. Similarly, a member of the ruling party invariably tries to defend the government policy or action in all situations sans a few exceptions. In fact, Budget itself is rather a technical subject and one needs a proper knowledge and understanding even to offer any express opinion or remarks. In such case, such reactions and responses of the political leaders so often become ridiculous or meaningless; nonetheless, being elected representatives of the public, their remarks and opinions do matter and cannot be summarily ignored or dismissed. The author proposes to cite here only a few reactions of the leaders of key opposition parties.

Mr Rahul Gandhi, Member of Parliament from Waynad, Kerala and de facto leader of the main opposition the Congress Party, ridiculed the Modi government’s term ‘Amrit Kaal’ and Budget in saying that its ‘Mitr kaal’ budget has no vision to create jobs as well as no plan to tackle inflation, and proves that the Centre has no roadmap to build India’s future. Senior Congress leader P. Chidambaram, Ex-finance minister during the previous UPA Government and now a charge-sheeted accused in a money-laundering case, alleged that Union Budget has “betrayed” the hopes of a vast majority of Indians and shows how far removed the government is from the people and their concerns about life. The Samajwadi Party Chief Akhilesh Yadav claimed that the BJP’s Budget is only adding to the inflation and unemployment. According to Aam Admi Party leader and Deputy CM Manish Sisodiya, the Budget was nothing but a ‘jumla’ (false promise) that would only immerse the country in debt. The Kerala Chief Minister P. Vijayan stated that the Union Budget did not attempt to solve the growing economic disparities in the country. West Bengal finance minister slated the Budget as anti-poor with no measures to bring down inflation. In short, these and many other opposition parties’ leaders did not see any good in the Budget and were critical of it in their own ways.

As against the reaction of opposition, most of the ruling party leaders and their supporters have hailed the Budget that it indeed fulfils the hopes and expectations of common man including the country’s poor, deprived and middle class as well as all sections including farmers, businessmen, women, youth and tribal population. Immediately after the presentation of the Budget, Prime Minister Narendra Modi said, “First Budget of Amrit Kaal will build a strong foundation for a developed India. It’ll fulfil dreams of middle class, poor, farmers. We’ve taken many steps for middle class.” The statement itself indicates his long term vision and commitment for the nation. Actually, this was Modi led Government’s fifth Budget of its 2nd term and was crucial on account of being last just before the approaching parliamentary elections in the prevailing global headwinds and high fiscal deficit but this Budget has earned right numbers in economics and politics as well because it indeed appears to build for future with carefully designed schemes and programmes for the different sectors and segments, including the required focus on the infrastructure and middle class.

While the Budget has been generally welcomed by different people including investors and business class, many experts agree that the finance minister has indeed gone for growth, boosting both investment and consumption. Even the IMF has opined that in spite of ensuing Lok Sabha poll pressures, the Budget reflects excellent emphasis on the economic growth with adequate focus on the public capital expenditure (CAPEX) and the financial sector. For the consecutive 3rd year, budget outlays on CAPEX show significant increase and the current 33% increase takes the Central Budget CAPEX outlays to over ten lakh crore which is about 3.3 percent of the GDP, nearly three times of what was provided during the financial year 2019-20. The multiplier effects from the public CAPEX have already started showing results in terms of India’s gradual emergence as the growth engine in the world economy. The continued emphasis on infrastructure sector is already yielding fine returns with investment in the economy, as measured by gross fixed capital rising to a little over 35% of GDP by 2021-22. The contribution of the manufacturing sector (18.2% of GDP) too is showing constant increase. A slew of measures taken in the financial sectors too are showing favourable outcomes and measures taken in the Budget for the ease of doing business are likely to attract and accelerate significant private investment.

Traditionally, the print and electronic media particularly the long established English dailies in India are dominated by the left and left-leaning liberals and bloggers who are so often found being critical of the programmes and policies of the present Central Government. While going through a few editorials on the Budget, this author was rather amazed to find one such editorial of an English Daily of repute and wide circulation describing the Finance Minister’s fifth budget as her best in terms of being economically smart, politically confident and fiscally credible and he grades it as the best compliment far this Budget. One such tagline of a popular national daily reads “Ahead of the 2024 Lok Sabha Elections, It’s Amrit Mahotsav for the Middle Class, A Traditional Vote Bank of Bhartiya Janta Party”. Thus the tax bonanza with income tax exemption upto 7.50 lakh with slabs reworked/rates reduced, 33% augmentation in CAPEX outlay for the consecutive third year with focus on infrastructure and Saptarishi-7 priorities under various schemes and programmes indeed make it an ideal Budget for a good beginning of the Amrit Kaal.

Author’s Note

A healthy opposition shall be called one that evaluates things on merit and offer its critical evaluation or remarks accordingly to the environment. The aforesaid remarks of the opposition parties merely reflect their lackadaisical approach, political improvidence or short-sightedness, or simply ignorance with which the majority politicians suffer these days. Gandhi scion’s ridiculing of Amrit Kaal as ‘Mitr kaal’ is neither a new development nor should be taken seriously as he habitually keeps on indulging into such childish gimmicks quite off and on. Perhaps many opposition and even ruling party members need to learn the basics of conducting self in public and Parliament from the leaders of the stature of late AB Vajpayee or even Narendra Modi. The budget and planning being one of the core areas of competence, this author has no hesitation to say that the maiden budget of Amrit Kaal is indeed capable of laying a strong foundation for the fulfilment of the long fostered vision of “India as a developed country” with its continued emphasis on CAPEX, rationalization of taxes and endeavour to maintain macroeconomic stability using fiscal prudence.

In opposition parties’ perspective, this may be a lackluster budget but it is a satisfactory engine of growth in real sense. If the planning and budgeting is effectively managed in the coming years with the efficient execution and implementation of the schemes and programmes hitherto fore, the projected dream $5 trillion economy may indeed materialize in the near future. However, there is a flip side too with riders. It is of common knowledge the oldest political party Congress is still fascinated with the Nehruvian ideology of socialistic economy and the most other national opposition parties including communists too largely follow the same flawed ideology and vision for development and growth that could neither assured poverty alleviation nor a sustained development of the country in the previous decades after independence. For instance, even during last Lok Sabha polls in 2019, the Congress Manifesto aggressively offered a monthly dole of Rs 6,000 to every poor family under the Nyuntam Aay Yojana (NYAY) supposedly after consulting their economist advisers including a Nobel Laureate. This culture of freebies and subsidies has prevailed in the country for the decades hindering the real development and growth.

It is part of history now that the successive Congress governments gave a loud call and publicity for the poverty alleviation, made fanciful announcements and legislation too but remained stuck with poor follow up action and implementation. The traditional regime of subsidies and freebies including largely the non-productive MGNREGA like schemes accrued only marginal benefits sans any significant improvement in the standard of living and economic condition of people. The NYAY is the latest wonder which was summarily rejected by the electorate in 2019. On the other hand, Mr Narendra Modi led NDA government, with clarity in its vision and mission, has constantly focused on the empowerment of poor people through improvising for them pucca houses, LPG connections, construction of toilets, direct transfer of financial assistance/subsidy, power connections, sanitation, piped water supply in villages, easy credit to start business/self-employment, and dozens of such other schemes as concrete steps towards improving the quality of life. Therefore, the continuance of the present socio-political and economic environment and culture is essential for a sustained development of the people and country.

Although there are a few minor aberrations such as constant fiddling with the import duties, selective concessions for certain products and compulsion of continued subsidies and freebies that the author would not like to dwell upon or overemphasize it for now. However, be it the national economy or individual households, deficit financing and excess borrowings are not healthy and good in long term for the socio-economic well-being. The estimated fiscal deficit in 2023-24 at the rate of 5.9% (17,86,816 Cr) of GDP brings no solace in mere comparison that it has been brought down from 6.2% in 2022-23. The purpose of the Fiscal Responsibility and Budget Management (FRBM) Act, 2003 introduced by the same NDA’s Vajpayee Government in 2003 was to progressively minimize the outstanding debt, eliminate revenue deficitand bring down the fiscal deficit to a manageable 2-3% of the GDP by a certain date (March 2008). During the Congress led UPA Government rule from 2004 to 2014, it remained like one step forward and two steps backwards all the time. The economic compulsions owing to the global fallout of Covid-19 pandemic are understandable but concrete measures to minimize borrowings and deficit financing are paramount to avoid nemesis like some of the neighbouring countries in future.

Image Source: Ministry of Finance website

31,434 total views, 9 views today

No Comments

Leave a comment Cancel